Intro: Cash Flow Cycle Explained | 1. Onboarding | 2. Invoicing | 3. Vendors | 4. Metrics | 5. Accounts Receivable Problems

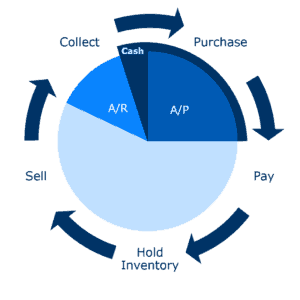

Today we’re going to go over the cash flow cycle. Every entrepreneur must understand this because it answers the key question: where is all my money? You can look at your P&L and you can see huge profits at the bottom of the sheet, you’re running a great business, you’re making lots of money, but it’s not all in the bank, is it? It’s not all in your pocket, you’re not taking it all home to the family. Where is it? I’m going to show you, today, I figured it out. Let’s learn about it. This is called the cash flow cycle. Cash flow cycle in technical terms tells you how long it takes for $1 to go all the way through your business and back out to your personal bank account. You put money in to start the business, how long does it take to go through the company cycle until you can take it home.

Here’s the key:

So out of the entire cycle, where’s the cash? A little tiny piece of the pie. If you think of the cycle as hands on a clock, you’ve got control of your cash for less than half of the time — Sometimes as little as 15 minutes out of that “hour” (see the blue graphic below)!

If you understand the concept that your money is in various places at various times in the cycle of your business, you can then calculate the number of days that it takes to go around the cycle.

Three simple formulas

Three simple formulasDays Sales Outstanding + DSO = A/R ÷ SALES × 365

Days Sales Outstanding (DSO) is equal to your accounts receivable (A/R) at any point in time, how much money do your clients owe you, divided by your annual sales; how much have you sold in the year, time 365 days.

Days Payables Outstanding − DPO = A/P ÷ PURCHASES × 365

Days Payables Outstanding is equal to accounts payable (A/P), divided by total purchases of the year. How much did you spend, all year long, on anything, multiplied by 365.

Days Sales in Inventory + DSI = INVENTORY ÷ COGS × 365

That’s the big black hole where you’re holding on to things that you’ve made. That’s the value of your inventory from the balance sheet, divided by the cost of goods sold for the whole year, multiplied by 365. Notice I said a whole year on each of these things. It’s important that these two terms match in the period that you’re measuring. So, if you were to do COGS for one month, multiply that times 30, instead of 365. For this example, we’ll keep it at a year.

Cost of goods sold for a whole year, times 365.

Purchases for a whole year, times 365.

Sales for a whole year, times 365.

If you can do those three pieces of math quickly, using your balance sheet and your income statement, then you can start to see the total number of days in your cycle. Add the days sales are outstanding, subtract the number of days you get back by letting your vendors finance your customers, then add the number of days in your inventory. In most businesses, AR runs about 45 days. In most businesses, accounts payable is less than accounts receivable, maybe only 30 days, so you’re 45 – 30, you’ve already got 15 days that you need to finance and if you hold inventory for another three months, guess what? You’re at 105 days’ worth of cash tied up in your business. You can play that game with all kinds of different numbers and you can see how a business could really go broke just trying to keep the doors open, because you’re storing cash inside the cycle. That’s important.

DSO – DPO + DSI

Keep that total as low as you can and read my blog about Dell Computers. I’ll show you how Dell Computers has a negative cash flow cycle. They use your cash to build machines that they sell you and have more cash than they need to keep their business running. It’s a great trick.

Shoot for that target. Go out and act. We’ll see you next time.

To your success,

David Worrell

Intro: Cash Flow Cycle Explained | 1. Onboarding | 2. Invoicing | 3. Vendors | 4. Metrics | 5. Accounts Receivable Problems

8326 Pineville Matthews Rd #407

Box #473831

Charlotte, NC 28226

Phone: (980) 819-0510

© 2018-2024 Fuse Financial Partners LLC. All rights reserved.