Think “Crowdfunding” and you might think of Kickstarter or Indiegogo. Both are good sites, but soon new crowdfunding rules will unlock powerful new options for fundraising online.

Yes, Kickstarter and other pre-sale sites have funneled over $1 billion to start-up projects since 2009, but serious angel investors and VC were not among those writing checks. Since investors can’t yet buy equity (ownership) in your company online, they are not typically interested in these kinds of crowdfunding sites.

QUICK HISTORY LESSON

In an attempt to protect investors and prevent another Great Depression, the Securities Acts of 1933 and 1934 force companies to register and document their fundraising activities (offerings). Since this is an arduous and expensive process, exemptions were created for smaller companies. Under Regulation D, start-ups and others can raise money from accredited investors in private forums. However, even these exemptions require so much legal work that the majority of the population cannot benefit from them.

TODAY’S JOBS ACT

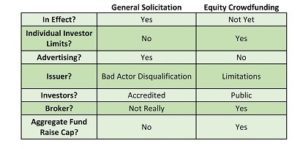

Enter the Jumpstart Our Business Startups (JOBS) Act. The JOBS Act was signed into law on April 5, 2012. It was created to stimulate the economy, but also contained provisions for new exemptions to Regulation D, including General Solicitation and Equity Crowdfunding. The following table serves to summarize how these new crowdfunding rules work:

BOTTOM LINE

What does all this mean? First, let’s take a look at General Solicitation, which is the new 506 (c) under the newly passed Title II of the JOBS Act. As of September 13, 2013, General Solicitation allows companies to publicly advertise for equity investments from accredited investors.

Businesses are allowed to advertise their investment opportunities to accredited investors in any medium, including social media. The true benefit of General Solicitation is that it increases the sphere of contacts in which a company can find investors. This make it easier and more likely that a company will find enough investors to complete their funding needs.

THE NEXT CHAPTER

The true value of the JOBS Act will be demonstrated when Title III is implemented, which is supposed to be by the end of 2014. Title III is true Equity Crowdfunding that will allow average investors (even those who are unaccredited and unsophisticated), to buy an equity investment in the next potential Facebook or Twitter. Instead of receiving gifts for funding future product releases, average investors will be eligible to buy equity in small, private companies.

As of this writing (July 2014) the SEC is still finishing up writing the crowdfunding rules and adding restrictions to protect investors. There will be limits to the amount of cash that individuals can invest in these companies, either in monetary amounts or as a percentage of income. These transactions will also need to be handled through a third party website (e.g. Angelist, WeFunder, etc.).

The SEC is seeking to protect individual investors since they will not require accreditation. They will be screening the startups and designating SEC registered brokers to act as intermediaries for these equity deals. There will also be a cap limiting the amount raised by crowdfunding to a maximum of $1 million per 12 month period.

FINALLY

The JOBS Act may make it easier for average Americans to invest in start-up companies, and for startups to raise capital, but the SEC is drawing a fine line between the benefit to companies and the need to protect the individual investor. Both General Solicitation and Equity Crowdfunding are promising developments, as small businesses are necessary to revitalize and strengthen our economy. Ultimately, the JOBS Act will better provide capital for entrepreneurs, while also giving everyone a chance to invest in innovation and economic development.

photo credit: Flying Minute Men via photopin cc

8326 Pineville Matthews Rd #407

Box #473831

Charlotte, NC 28226

Phone: (980) 819-0510

© 2018-2024 Fuse Financial Partners LLC. All rights reserved.